Which Top 10 Features are Absent in Microsoft Word and Excel for Effective Invoicing in the UK?

Microsoft Word and Excel are widely used tools for creating invoices but they lack several critical features such as automation, database integration, real-time tracking, and direct payment solutions—elements necessary for a more efficient invoicing procedure.

In the dynamic business environment, efficient invoicing is vital for managing cash flow and maintaining professional relations with clients. Many small businesses in the UK utilise Microsoft Word and Excel for their invoicing needs, yet find themselves hindered by these applications' limitations, missing critical features necessary for effective invoicing. Here are the key features missing from Word and Excel that are essential for a smooth invoicing experience.

-

Automation of Invoices in Word

Automation minimizes repetitive tasks, but Word requires manual data insertion for every invoice, which may lead to errors and results in wasted time.

Example: A company spends countless hours re-entering customer data for various clients each month.

-

Centralised Customer Database Integration in Word

Word does not support integration with a centralised database for customer information, necessitating manual data collection from disparate sources.

Example: Switching between different applications to gather data, increasing the probability of errors.

-

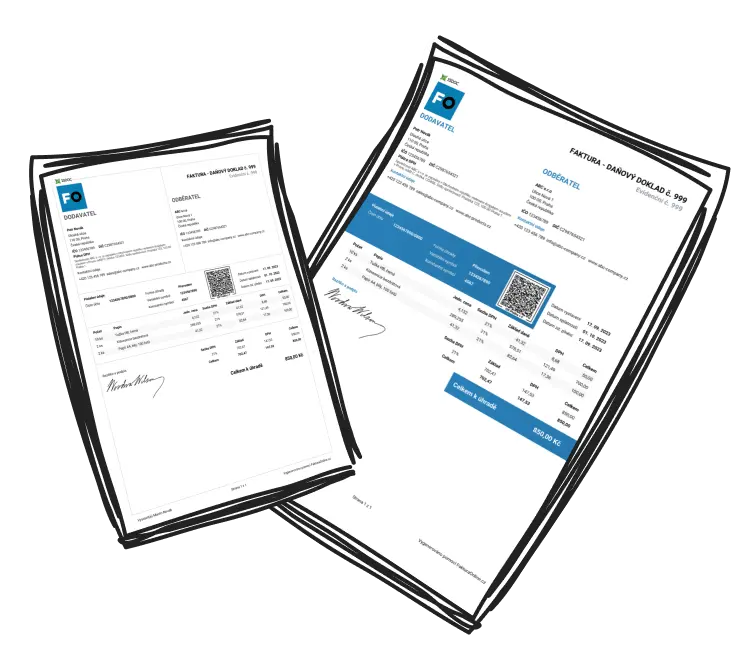

Direct Payment Options in Word

Word lacks direct payment features like QR codes, complicating payment operations.

Example: Clients receive separate payment instructions, causing delays and misunderstandings.

-

Real-Time Invoice Tracking - A Key Missing Feature in Word

Word does not support real-time tracking of invoice statuses, causing businesses to manually verify paid or overdue invoices.

Example: Time is squandered by checking records and reaching out to customers regarding payment statuses.

-

Consistent Template Customisation in Word

Consistency in the appearance of invoices is tough to maintain, affecting their professional look.

Example: Inconsistent font sizes or layouts can create confusion during audit processes.

-

Automatic Calculations in Excel

Although Excel excels at handling numerical data, it does not provide automatic calculations tailored specifically for invoicing.

Example: Users manually input and verify figures, increasing the chances of calculation errors.

-

Integration with Accounting Software in Excel

A seamless link between invoices and accounting systems is absent.

Example: Financial records need manual updates to ensure accounts remain correct.

-

Error-Checking Features in Excel

Excel does not offer invoicing-specific error checks, raising the risk of unnoticed inaccuracies.

Example: Minor data entry mistakes could result in significant financial inconsistencies.

-

Recurring Billing Options in Excel

Setting up recurring invoices for subscription services is complex.

Example: Businesses must manually recreate invoices each billing cycle, increasing workload.

-

In-Depth Reporting and Insights in Excel

Generating meaningful insights from invoicing data in Excel requires additional manual effort.

Example: More steps are needed to extract transaction histories and identify trends.

To overcome these feature deficiencies in Word and Excel, UK businesses can opt for comprehensive invoicing software. For an efficient invoicing solution, consider trying InvoiceOnline. It offers a free trial with no registration required, enabling businesses to create and manage invoices promptly and securely.

Alternatives for Invoicing Software:

Specialised software delivers automation, integration with customer databases, and real-time payment tracking.

Tip: Gradually transition by testing these tools with free trials to assess their functionality and ease of use.

Addressing these feature gaps with specialised invoicing solutions can greatly improve business operations and financial management, streamlining processes in line with modern business practices.