How to Ensure Your Invoices Are Paid Promptly

Including comprehensive details, adopting a professional look, and leveraging invoicing tools can guarantee timely payments for your invoices. Understanding each step is vital to avoid frequent errors and optimise your invoicing process.

Issuing invoices is a fundamental business function directly impacting your cash flow. A well-crafted invoice not only secures prompt payment but also bolsters your professionalism. This guide walks you through creating an effective invoice that ensures timely payment.

1. The Importance of Accurate Invoicing

The precision and clarity of an invoice can greatly influence how swiftly a client will pay. Overlooked details can cause confusion, miscommunication, or disputes, leading to delayed payments. For example, a British entrepreneur found themselves waiting an additional month for payment due to missing the invoice number, complicating tracking for their client. Avoiding such issues is key to ensuring timely payments and smooth operations.

2. Essential Components of an Invoice

Incorporating all key information in your invoice is essential. Here's a checklist you should follow:

Your business name and contact information

The client's name and contact information

A unique invoice number

The invoice date and payment due date

An itemised list of services or products with descriptions, quantities, and prices

The total sum due with applicable taxes or discounts

Payment terms and accepted payment methods

Additional notes to maintain professionalism

Tip: Specifying payment terms like "Net 30" motivates clients to pay within 30 days of the invoice issue date, helping to minimize delays.

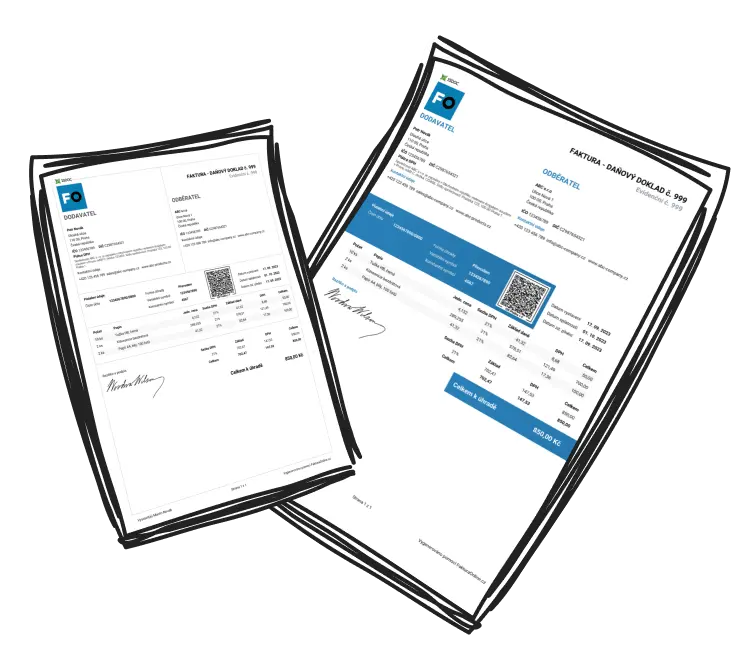

3. Designing a Professional Invoice

Even without formal design training, you can produce a clean, professional-looking invoice. Start by choosing simple fonts and a colour palette aligned with your brand identity. Ensure your company's logo is prominently placed. Use available invoice templates on various software platforms as they are crafted to balance aesthetic and functional elements.

Example: Employ a grid-based structure in your template to methodically organise sections such as client info, billed items, and payment details, which enhances clarity.

Tip: Use white space wisely to avoid clutter; it aids in making information easy to digest and comprehend.

4. The Role of Invoicing Software

Modern invoicing software can save time and mitigate errors. These tools often offer features that streamline the invoicing process:

Automated calculations for totals and taxes

Pre-designed templates that look professional

Tracking features to help ensure unpaid invoices are followed up

Automated payment reminders to keep clients on track

Example: While there are many software options available, select one that offers browser-based invoicing capabilities with varied types and secure data handling for peace of mind.

5. Avoiding Common Invoice Mistakes

Little mistakes on an invoice can create a negative impression or result in payment delays. Be aware of these common pitfalls:

Missing essential client details

Using incorrect or outdated invoice numbers

Calculation or description errors

Failing to proofread for typographical errors

Tip: Verify all details and calculations before dispatching your invoice to maintain accuracy and professionalism.

By implementing these practices and using appropriate tools, you'll be positioned to create invoices that exhibit your professionalism and confidently result in timely payments.